Exploring Revenue Models and Monetization Strategies

Cashback apps have transformed how people shop, providing a win-win situation for both consumers and businesses. They attract users by offering a percentage of their purchases back in cash, while merchants gain loyal customers. But have you ever wondered how these apps themselves generate revenue while giving money back to their users? The secret lies in innovative revenue models and monetization strategies.

If you’re planning to create such an app, consulting with a mobile app development company in New York can help bring your vision to life with the right features and strategies.

Understanding Cashback Apps

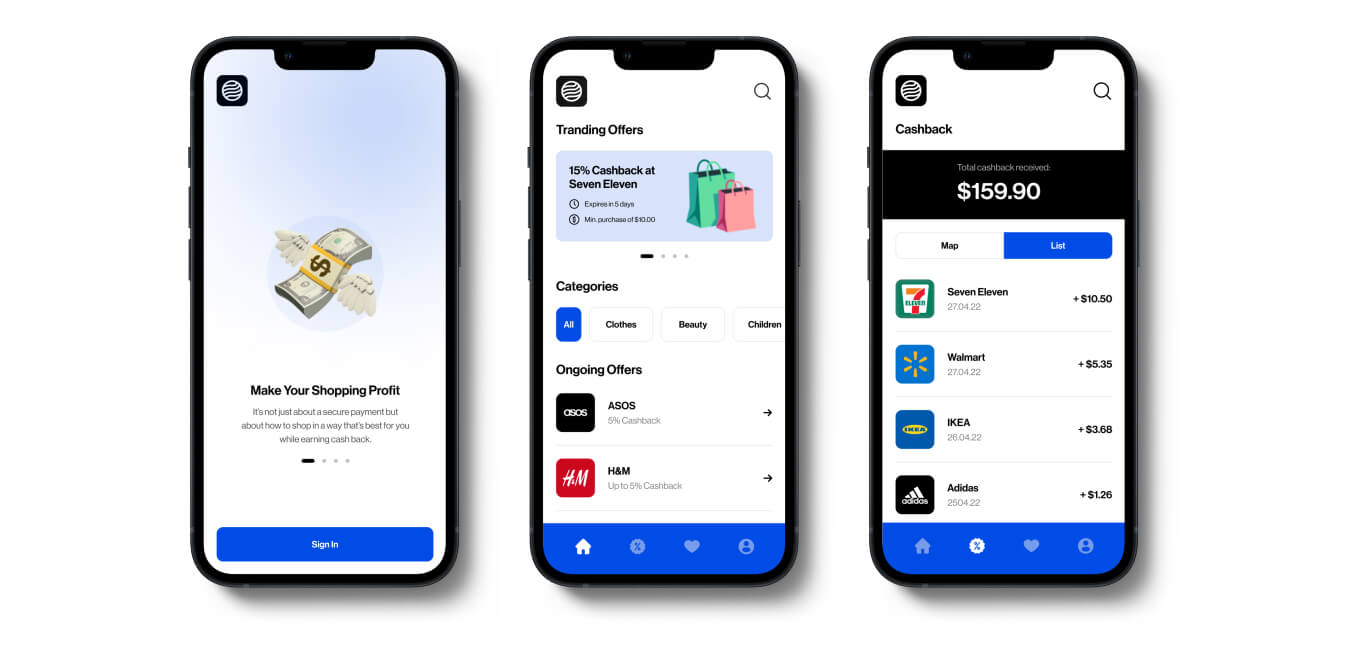

Cashback apps are platforms that reward users with a portion of their spending as “cashback” for shopping through their app or using affiliated retailers. These apps act as intermediaries between consumers and businesses, earning revenue by facilitating transactions. Let’s dive deeper into their revenue models.

Revenue Models of Cashback Apps

- Affiliate Marketing Commissions

The primary way cashback apps make money is through affiliate marketing. Retailers partner with cashback platforms to promote their products or services. When a user shops through the app, the retailer pays the app a commission, which is then split between the user and the app.For example, if a retailer offers a 10% commission on sales and the app gives 5% cashback to the user, the app retains the remaining 5% as profit. This model benefits all parties:- Retailers get increased sales and visibility.

- Users save money.

- The app earns revenue without selling products directly.

- Subscription Plans

Many cashback apps offer premium subscription plans for users. Subscribers gain access to higher cashback rates, exclusive deals, or faster payouts. This recurring revenue stream can be highly lucrative.Subscription-based models are especially successful when combined with features like real-time notifications, personalized offers, and seamless integration with other shopping platforms. A skilled app development company in New York can integrate these functionalities for a better user experience. - Featured Listings and Ads

Retailers often pay cashback apps to feature their stores or products more prominently on the app. These sponsored listings ensure better visibility, driving more traffic to the retailer.Additionally, cashback apps display targeted advertisements based on user behavior. By leveraging user data, these apps can sell ad space to businesses looking to target specific demographics. - Partnerships with Financial Institutions

Many cashback apps partner with banks, credit card companies, or payment gateways. These partnerships help drive transactions on specific payment platforms. In return, the app earns a percentage of the transaction fees or a fixed amount per referral. - Data Monetization

Cashback apps collect valuable user data, including shopping habits, spending patterns, and preferences. This anonymized data can be sold to retailers, market research firms, or advertising agencies. Insights derived from this data help businesses tailor their marketing strategies and products.However, data monetization must be done ethically and in compliance with privacy laws like GDPR or CCPA. Reliable app developers in New York understand these regulations and can ensure your app remains compliant. - White-Label Solutions

Some cashback apps generate revenue by offering white-label solutions to businesses. They license their app’s core technology and infrastructure to other companies, enabling them to create branded cashback programs without starting from scratch. - In-App Purchases

Certain cashback platforms gamify the shopping experience by introducing rewards, badges, or exclusive deals that can be unlocked through in-app purchases. Users might pay to access premium features, boosting the app’s revenue.

Monetization Strategies: Beyond Revenue Models

Cashback apps thrive by strategically implementing monetization methods that ensure long-term profitability.

1. User Retention Strategies

To maximize revenue, cashback apps focus on retaining users. Loyalty programs, gamification, and personalized deals keep users engaged. Building these features effectively requires expertise, and a mobile app development company in New York can help integrate them seamlessly.

2. Scalability and Expansion

Many cashback apps expand their operations to include partnerships with more retailers, regional expansion, or even cross-border shopping options. This diversification ensures consistent revenue streams.

3. Real-Time Analytics

Cashback apps use real-time analytics to identify trends, optimize user engagement, and offer timely deals. This capability allows them to refine their monetization strategies effectively.

4. Cross-Promotions

Cashback apps often collaborate with other apps or services, such as travel booking platforms, food delivery apps, or fintech tools, to offer exclusive cross-promotional deals. These collaborations create additional revenue opportunities.

Challenges and How to Overcome Them

Although cashback apps have a lucrative business model, they face several challenges:

- High Competition

With many players in the market, differentiation is crucial. Unique features, seamless user experiences, and effective marketing strategies are essential to stand out. Partnering with experienced mobile app developers in New York can help create an app that excels in design and functionality. - Cash Flow Management

Cashback payouts require significant upfront investment. Managing cash flow while ensuring user satisfaction can be tricky. A robust backend system is necessary to maintain financial stability. - Compliance with Regulations

Data privacy laws and financial regulations vary across regions. Compliance ensures user trust and avoids legal complications. Trusted app development companies in New York can implement secure systems and encryption to meet these requirements. - User Trust

Users are more likely to engage with apps that provide transparency about cashback policies, secure payment options, and responsive customer service.

Building a Successful Cashback App

To build a successful cashback app, it’s essential to incorporate the following features:

- User-Friendly Interface: A seamless and intuitive design encourages user engagement.

- Secure Payment Systems: Users need assurance that their transactions are safe.

- Personalization: AI-driven personalization improves user satisfaction and retention.

- Real-Time Tracking: Allow users to track their cashback earnings in real-time.

- Cross-Platform Compatibility: Ensure your app works on both iOS and Android devices.

By working with a reliable app development company in New York, you can create a scalable, feature-rich app that stands out in a crowded market.

The Future of Cashback Apps

The cashback app industry shows no signs of slowing down. With advancements in AI and machine learning, these apps are becoming smarter, offering hyper-personalized deals and recommendations. As mobile commerce grows, cashback apps will continue to evolve, adopting innovative revenue models and expanding their reach.

For businesses looking to capitalize on this trend, collaborating with experienced mobile app developers in New York is the first step toward success. By leveraging cutting-edge technology and user-centric design, you can create a cashback app that not only meets user expectations but also maximizes revenue.

Whether you’re a business planning to launch a cashback app or an entrepreneur exploring this space, understanding these revenue models and monetization strategies is key. Partner with an expert mobile app development company in New York to bring your ideas to life and make a mark in this competitive industry.