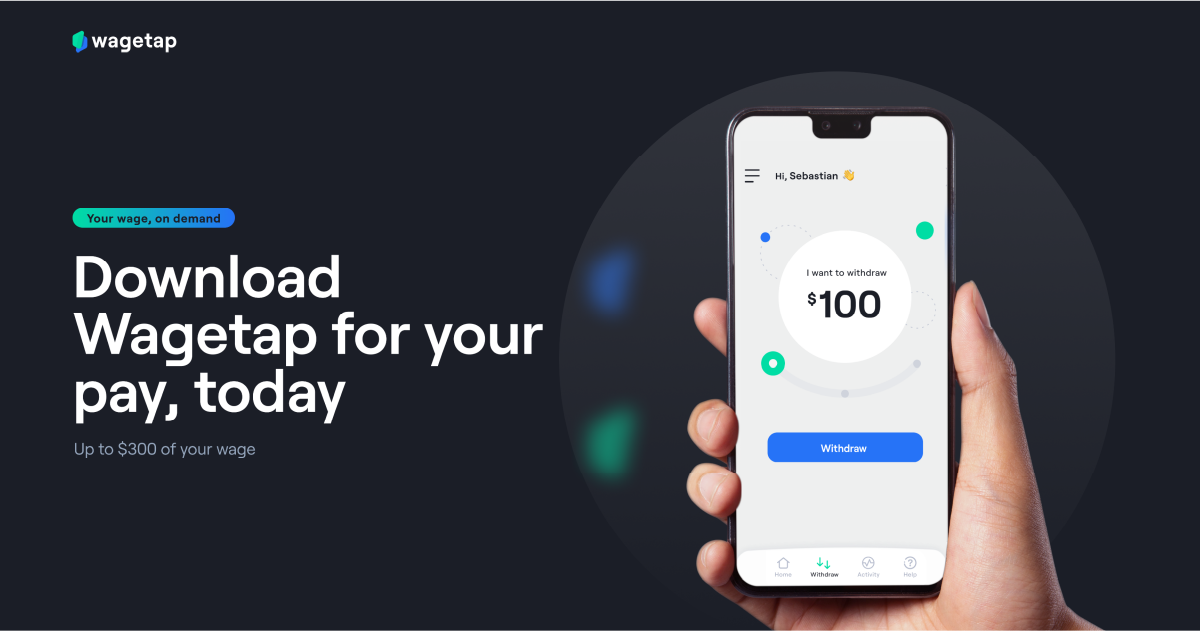

In today’s fast-paced world, cash advance apps like Wagetap are becoming increasingly popular. These apps provide users with instant access to small loans or a portion of their paycheck before payday, offering financial flexibility and helping users manage unexpected expenses. If you’re considering developing a cash advance app similar to Wagetap, understanding the development costs involved is crucial.

Key Features of a Cash Advance App

To estimate the cost accurately, it’s essential to outline the core features that make a cash advance app functional and user-friendly:

- User Registration & Authentication: Secure sign-up and login options using email, phone number, or social media accounts.

- Account Linking: Integration with bank accounts for seamless transactions.

- Loan Application & Approval: Simple interfaces for users to request advances and receive approvals.

- Loan Disbursement: Instant transfer of funds to the user’s account.

- Repayment Scheduling: Automated repayment setup aligned with the user’s payday.

- Push Notifications: Alerts for due payments, approvals, and promotions.

- Security Protocols: Advanced encryption, two-factor authentication, and compliance with financial regulations.

- Customer Support: In-app chat or help center for user queries.

- Admin Dashboard: Tools for monitoring transactions, user activity, and system performance.

Factors Influencing Development Cost

- Platform Choice (iOS, Android, or Both): Developing for a single platform is less expensive than building for both. A cross-platform solution using Flutter or React Native may optimize costs.

- Design Complexity: A user-friendly and attractive UI/UX design can increase costs depending on customization levels.

- Third-Party Integrations: Integrations with payment gateways, credit scoring services, and banking APIs add to the development cost.

- Security Measures: Implementing robust security features to protect sensitive financial data increases both time and cost.

- Compliance and Legal Requirements: Adhering to financial regulations (such as GDPR, PCI DSS) requires additional resources.

- Development Team Location: Costs vary depending on whether you hire developers from North America, Europe, or Asia.

- Maintenance and Updates: Post-launch support, updates, and bug fixes are ongoing costs to consider.

Estimated Cost Breakdown

- MVP Development: $30,000 – $60,000

- Full-Featured App: $70,000 – $150,000

- Maintenance and Updates (Annual): 15-25% of the initial development cost

Timeline for Development

- MVP: 4 to 6 months

- Full-Featured App: 8 to 12 months

How Winklix Can Help

At Winklix , a leading mobile app development company in Sydney , we specialize in developing custom fintech solutions tailored to your business needs. Our expert team of developers, designers, and strategists can guide you through every stage of app development—from ideation to launch and beyond. With experience in integrating advanced security measures and compliance protocols, we ensure your app is secure, scalable, and user-friendly.

Conclusion

Building a cash advance app like Wagetap requires careful planning, robust security, and adherence to financial regulations. While the development cost varies depending on features and complexity, partnering with an experienced development firm like Winklix can help you navigate challenges and bring your vision to life. Contact us today to discuss how we can help you build a cutting-edge financial solution.