In today’s digital landscape, static user interfaces are a relic of the past. Users crave experiences that are intuitive, engaging, and, most importantly, personal. This is where the powerful combination of Flutter and Artificial Intelligence (AI) truly shines. Imagine an e-commerce app that doesn’t just display products, but proactively suggests items you’ll love, or a news feed that curates articles based on your evolving interests. This isn’t science fiction; it’s the reality Flutter and AI are making possible.

The Power Duo: Flutter’s UI Prowess Meets AI’s Brains

Flutter, Google’s UI toolkit for building natively compiled applications for mobile, web, and desktop from a single codebase, brings unparalleled speed and flexibility to UI development. Its declarative nature and rich set of customizable widgets make it a dream for creating beautiful and highly responsive interfaces.

But a beautiful UI alone isn’t enough for true personalization. This is where AI steps in. By leveraging AI insights, Flutter UIs can become “smart” – adapting and personalizing content in real-time. This dynamic content generation and personalization can manifest in various ways:

- Hyper-personalized Product Suggestions (E-commerce): Moving beyond simple “customers who bought this also bought…” AI can analyze a user’s Browse history, purchase patterns, demographics, and even sentiment from reviews to offer highly relevant product recommendations. Imagine an e-commerce app where the homepage layout, product carousels, and even promotional banners are dynamically generated to match each individual user’s preferences, leading to increased conversions and customer satisfaction.

- Adaptive News Feeds and Content Curation: News apps can go beyond topic-based subscriptions. AI can learn a user’s reading habits, preferred sources, and engagement with different types of content to create a constantly evolving, personalized news feed. This could include prioritizing breaking news from trusted sources, suggesting deeper dives into topics a user has shown interest in, or even filtering out content that consistently receives low engagement.

- Intelligent Chatbots and Virtual Assistants: Flutter can power the front-end of AI-driven chatbots that offer more than just pre-programmed responses. These chatbots can understand natural language, learn from past interactions, and provide truly personalized assistance, whether it’s helping a user troubleshoot an issue, navigate an app, or even complete a transaction.

- Dynamic UI Layouts and Theming: Imagine an app that subtly changes its color scheme, font sizes, or even the arrangement of its UI elements based on user preferences, environmental factors (like time of day or location), or even the user’s emotional state detected through AI analysis. While still an emerging area, this level of dynamic UI adaptation could create truly immersive and comfortable user experiences.

How Flutter Integrates with AI: The Technical Side

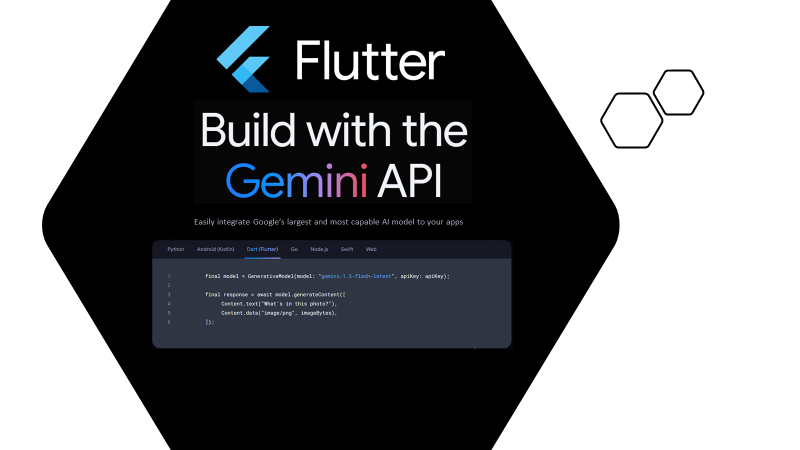

Flutter’s versatility allows for seamless integration with various AI frameworks and services:

- On-device AI with TensorFlow Lite: For real-time processing and privacy-sensitive applications, Flutter can integrate with TensorFlow Lite. This allows you to run lightweight machine learning models directly on the user’s device, enabling features like image recognition, text classification, or custom gestures without relying on cloud connectivity.

- Cloud-based AI with Google ML Kit, Firebase, and OpenAI: For more complex AI tasks requiring significant computational power, Flutter apps can leverage cloud-based AI services. Google ML Kit provides a range of ready-to-use APIs for common machine learning tasks, while Firebase AI Logic offers a streamlined way to integrate generative AI models like Google Gemini. Furthermore, community-supported packages allow Flutter developers to connect with powerful AI APIs from providers like OpenAI for advanced natural language processing and content generation.

- Custom AI Model Integration: For highly specialized use cases, developers can train their own AI models and integrate them into their Flutter applications using various methods, including platform channels for native code integration or RESTful APIs to communicate with custom backend AI services.

Building the Future: Considerations for AI-Powered Flutter UIs

While the possibilities are exciting, a few key considerations are crucial when building AI-powered Flutter UIs:

- Data Privacy and Security: Handling user data for personalization requires a strong focus on privacy and security. Transparent data policies and robust security measures are paramount to building user trust.

- Performance Optimization: AI computations can be resource-intensive. Optimizing AI model sizes, leveraging on-device inference where appropriate, and employing efficient data handling strategies are essential for maintaining a smooth and responsive user experience.

- User Feedback and Iteration: The beauty of AI is its ability to learn and improve. Implementing mechanisms for user feedback (e.g., “was this recommendation helpful?”) and continuously iterating on AI models based on user interactions will lead to increasingly accurate and valuable personalization.

- Ethical AI Practices: As AI becomes more integrated into user interfaces, developers must consider ethical implications, ensuring fairness, transparency, and avoiding biases in AI-driven decisions.

The Road Ahead

Flutter, with its robust UI capabilities and growing ecosystem for AI integration, is poised to lead the charge in creating the next generation of intelligent, adaptive, and hyper-personalized user experiences. From transforming e-commerce into a truly bespoke shopping journey to making content consumption more relevant and engaging, the fusion of Flutter and AI is not just enhancing UIs; it’s redefining how users interact with technology. The future of mobile applications is smart, dynamic, and intensely personal, and Flutter is a key enabler of this exciting evolution.