The rise of fintech has revolutionized how we access financial services, and money lending apps are at the forefront of this transformation. Offering quick and convenient loans, these apps are increasingly popular. But if you’re looking to build your own lending app, one of the first questions you’ll ask is: “How much will it cost?”

Unfortunately, there’s no single, definitive answer. The cost of developing a money lending app can vary significantly based on several factors. However, we can break down the key elements that influence the price tag to give you a clearer picture.

Factors Influencing Money Lending App Development Cost:

- Complexity of Features:

- Basic Features: A simple app with loan application, approval, and disbursement functionalities will be less expensive.

- Advanced Features: Integrating features like credit scoring, risk assessment, fraud detection, multiple payment gateways, and sophisticated reporting will drive up the cost.

- Examples:

- Real-time credit scoring using AI/ML.

- Automated loan approval and disbursement.

- In-app payment reminders and notifications.

- Integration with third-party data providers.

- KYC and AML compliance features.

- Platform (iOS, Android, or Both):

- Developing for a single platform (iOS or Android) will be cheaper than developing for both.

- Cross-platform development frameworks can reduce costs, but they might have limitations.

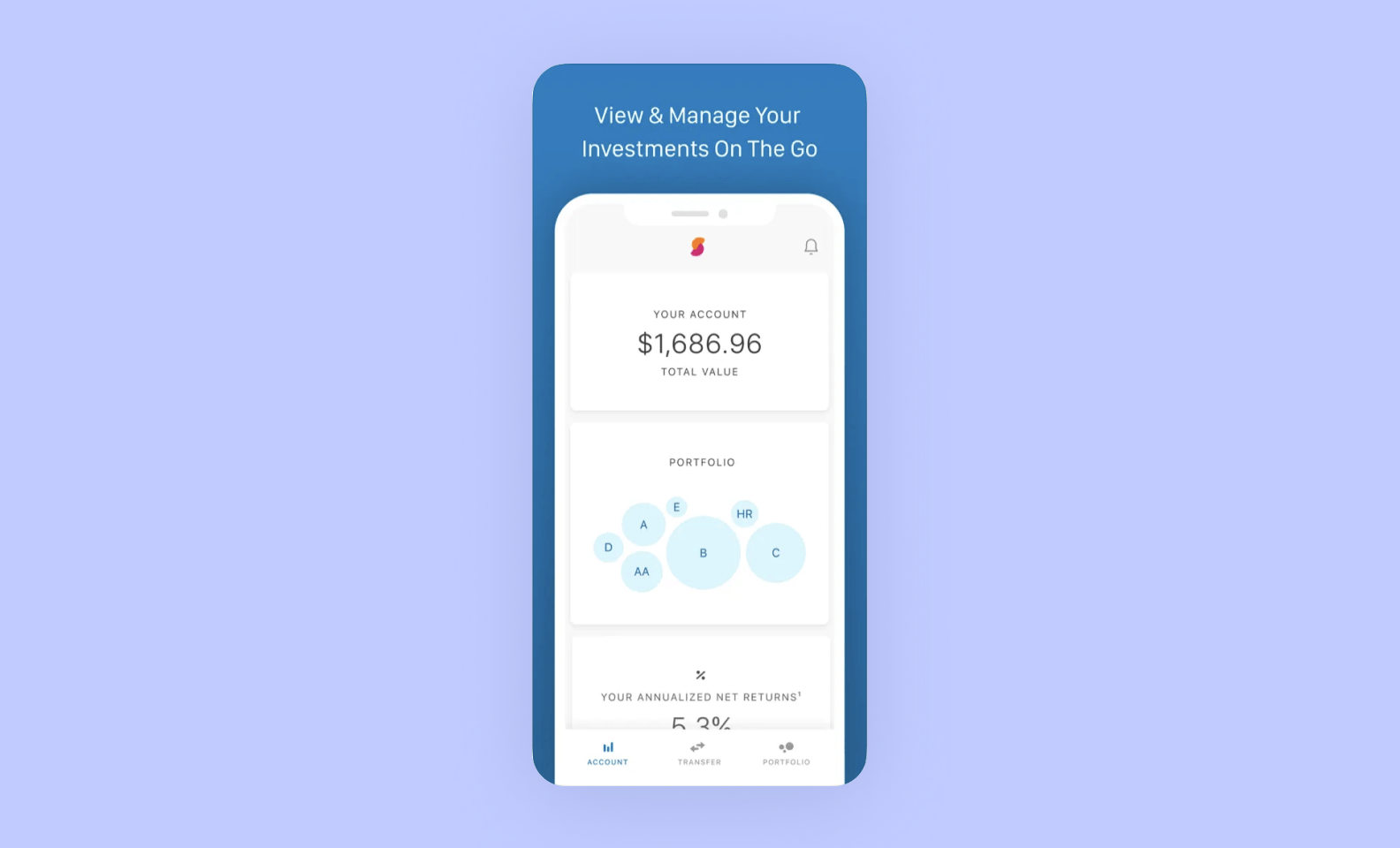

- App Design and User Experience (UX/UI):

- A simple, basic design will be less costly than a custom, visually appealing design with a seamless user experience.

- UX/UI design is extremely important for a lending app. Users need to feel secure and have a simple process.

- Backend Development and Infrastructure:

- The complexity of the backend infrastructure, including database management, security, and scalability, will impact the cost.

- Backend must be very secure, to protect sensitive financial data.

- Development Team Location and Expertise:

- Development costs vary based on the location of the development team.

- Experienced developers with expertise in fintech and security will charge higher rates.

- Offshore development can reduce costs, but communication and quality control are crucial.

- Compliance and Regulatory Requirements:

- Adhering to financial regulations and compliance standards (like KYC/AML) requires specialized expertise and can add to the cost.

- These regulations vary greatly by region, and must be researched and implemented correctly.

- Testing and Quality Assurance:

- Thorough testing is essential to ensure the app’s functionality, security, and reliability.

- This includes unit testing, integration testing, and user acceptance testing.

- Maintenance and Support:

- Ongoing maintenance, updates, and support are necessary to keep the app running smoothly and securely.

- This will add to the overall long term cost.

Estimated Cost Range:

While it’s difficult to give an exact figure, here’s a rough estimate:

- Basic Money Lending App: $20,000 – $50,000.

- Intermediate Money Lending App: $50,000 – $150,000.

- Advanced Money Lending App: $150,000+.

Key Considerations:

- Security: Security is paramount for a money lending app. Invest in robust security measures to protect sensitive user data.

- Scalability: Ensure the app can handle a growing user base and transaction volume.

- Compliance: Understand and adhere to all relevant financial regulations.

- User Experience: Create a user-friendly and intuitive app that provides a seamless experience.

Also Read : How Do You Create An Effective Brand Voice For Your Company?

Finding the Right Development Partner:

Choosing the right development partner is crucial for the success of your money lending app. Look for a company with:

- Proven experience in fintech app development.

- Expertise in security and compliance.

- A strong portfolio of successful projects.

- Transparent communication and project management.

In conclusion, developing a money lending app is a significant investment. By carefully considering the factors that influence cost and partnering with a reputable development team, you can build a successful and secure app that meets your business goals.