In the ever-evolving landscape of business technology, artificial intelligence (AI) has emerged as a game-changer, particularly in the realm of sales. By harnessing AI-driven insights, organizations can enhance productivity, streamline processes, and foster deeper customer relationships. Salesforce, a leader in customer relationship management (CRM) software, provides a robust platform to enable AI-driven sales transformation. Here, we explore how Salesforce’s AI capabilities can revolutionize your sales processes and drive success.

The Need for AI in Sales

Modern sales teams face unprecedented challenges—increased competition, rapidly changing customer expectations, and the growing complexity of data management. Traditional sales methods, while effective to some extent, often fall short in addressing these challenges. AI brings precision, scalability, and predictive power to the table, enabling sales teams to:

- Understand Customer Behavior: Analyze patterns to anticipate customer needs.

- Enhance Productivity: Automate repetitive tasks, freeing up time for high-value activities.

- Personalize Engagement: Deliver tailored experiences based on real-time data insights.

- Improve Forecasting: Leverage predictive analytics for accurate sales predictions.

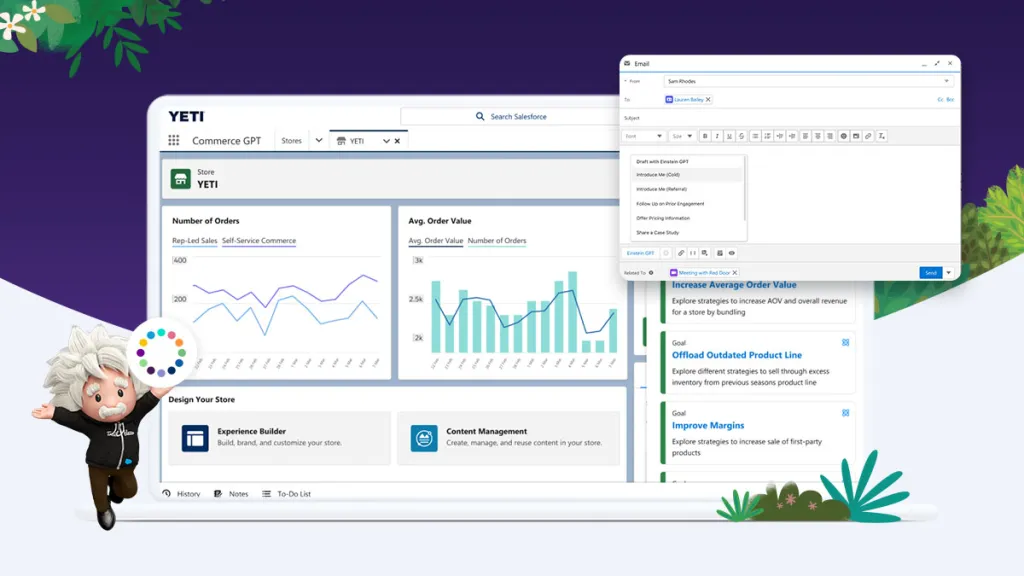

Salesforce Einstein: AI at the Core

At the heart of Salesforce’s AI capabilities is Einstein, a suite of AI-powered tools designed to seamlessly integrate with Salesforce’s ecosystem. Einstein enables organizations to:

- Analyze Data Automatically: Einstein Discovery identifies key insights and trends from data.

- Automate Tasks: Einstein Automate helps create workflows that reduce manual intervention.

- Predict Outcomes: Predictive models suggest the likelihood of sales opportunities closing.

- Enhance Customer Interactions: Einstein Bots improve customer support and lead generation through AI-driven conversations.

Key Features of Salesforce for AI-Driven Sales

1. AI-Powered Lead Scoring

Lead scoring helps prioritize high-potential leads. Einstein Lead Scoring evaluates historical data and behavior to assign a score to each lead. Sales reps can focus on the most promising opportunities, improving conversion rates.

2. Sales Forecasting and Insights

Salesforce’s forecasting tools leverage AI to provide accurate predictions. These insights help sales managers make informed decisions about resource allocation and strategy adjustments.

3. Opportunity Insights

Einstein Opportunity Insights provides actionable recommendations for each deal. For example, it might identify deals at risk of stalling or suggest the next best action to move a deal forward.

4. Enhanced Productivity with Automation

Routine tasks like data entry, follow-up reminders, and meeting scheduling can be automated through Salesforce’s AI tools. This reduces administrative overhead, allowing sales teams to focus on building relationships.

5. Personalized Customer Engagement

Einstein’s AI-powered algorithms analyze customer interactions and preferences to recommend personalized communication strategies. This fosters trust and loyalty, increasing the likelihood of repeat business.

Implementation Strategies for Success

To fully leverage Salesforce’s AI capabilities, businesses need a strategic approach:

1. Define Clear Objectives

Identify specific challenges or goals—whether it’s increasing conversion rates, improving customer retention, or enhancing sales forecasting.

2. Ensure Data Quality

AI’s effectiveness depends on high-quality data. Implement robust data governance policies to maintain accurate, up-to-date records.

3. Invest in Training

Equip your sales team with the skills needed to utilize Salesforce’s AI tools effectively. Provide ongoing training to ensure they remain adept at leveraging new features.

4. Integrate Across Teams

AI-driven insights are most impactful when shared across departments. Ensure seamless collaboration between sales, marketing, and customer service teams within Salesforce.

5. Monitor and Optimize

Continuously measure the performance of AI-driven strategies. Use Salesforce’s analytics tools to refine processes and maximize ROI.

Real-World Success Stories

Company A: Reducing Sales Cycle Times

By implementing Einstein Opportunity Insights, Company A identified bottlenecks in its sales process. AI-driven recommendations helped reduce the average sales cycle time by 20%.

Company B: Boosting Lead Conversion

Company B used Einstein Lead Scoring to prioritize high-value leads. This led to a 30% increase in conversion rates within the first quarter of implementation.

Company C: Improving Forecast Accuracy

With Salesforce’s AI-driven forecasting tools, Company C achieved a 95% forecast accuracy rate, enabling better resource allocation and strategic planning.

The Future of AI-Driven Sales with Salesforce

As Salesforce continues to innovate, the potential for AI-driven sales transformation will only grow. Emerging technologies like generative AI and advanced natural language processing will further enhance the platform’s capabilities. Organizations that adopt these tools today will be well-positioned to stay ahead of the curve.

Conclusion

AI is no longer a futuristic concept—it’s a critical component of modern sales strategies. Salesforce, with its robust AI capabilities, provides the tools needed to transform sales processes, drive efficiency, and foster meaningful customer relationships. By leveraging Salesforce for AI-driven sales transformation, businesses can unlock new levels of growth and success in an increasingly competitive marketplace.